Macro topic 4.2 nominal v. real interest rates delves into the intricacies of interest rates, exploring their definitions, calculations, and the critical relationship between them. By understanding the implications of both nominal and real interest rates, businesses and consumers can make informed decisions that align with their financial goals.

Nominal interest rates, representing the face value of interest charged on a loan, are influenced by factors such as inflation and market conditions. On the other hand, real interest rates adjust for inflation, providing a truer reflection of the actual cost of borrowing or the return on savings.

Nominal Interest Rates: Macro Topic 4.2 Nominal V. Real Interest Rates

Nominal interest rates are the interest rates that are charged on loans and paid on deposits. They are expressed as a percentage of the loan or deposit amount. For example, a loan with a nominal interest rate of 5% will charge the borrower 5% of the loan amount each year.

A deposit with a nominal interest rate of 5% will pay the depositor 5% of the deposit amount each year.Nominal interest rates are calculated using the following formula:“`Nominal interest rate = (Interest amount / Principal amount) x 100%“`For example, if a loan of $1,000 has an interest charge of $50, the nominal interest rate is 5%.“`Nominal

interest rate = ($50 / $1,000) x 100% = 5%“`Nominal interest rates can vary depending on a number of factors, including the type of loan or deposit, the creditworthiness of the borrower, and the economic conditions.

Real Interest Rates

Real interest rates are the interest rates that are adjusted for inflation. They are calculated by subtracting the inflation rate from the nominal interest rate. For example, if the nominal interest rate is 5% and the inflation rate is 2%, the real interest rate is 3%.“`Real

interest rate = Nominal interest rate

Inflation rate

“`Real interest rates are important because they measure the true cost of borrowing or the true return on saving. For example, if the nominal interest rate is 5% and the inflation rate is 2%, the real interest rate is 3%. This means that the borrower is actually paying 3% more in interest than they would if the inflation rate was 0%. Similarly, the saver is actually earning 3% less in interest than they would if the inflation rate was 0%.Real

interest rates can also be used to compare the cost of borrowing or the return on saving in different countries. For example, if the nominal interest rate in the United States is 5% and the inflation rate is 2%, the real interest rate is 3%. If the nominal interest rate in the United Kingdom is 4% and the inflation rate is 1%, the real interest rate is 3%. This means that the cost of borrowing or the return on saving is the same in both countries, even though the nominal interest rates are different.

Relationship between Nominal and Real Interest Rates

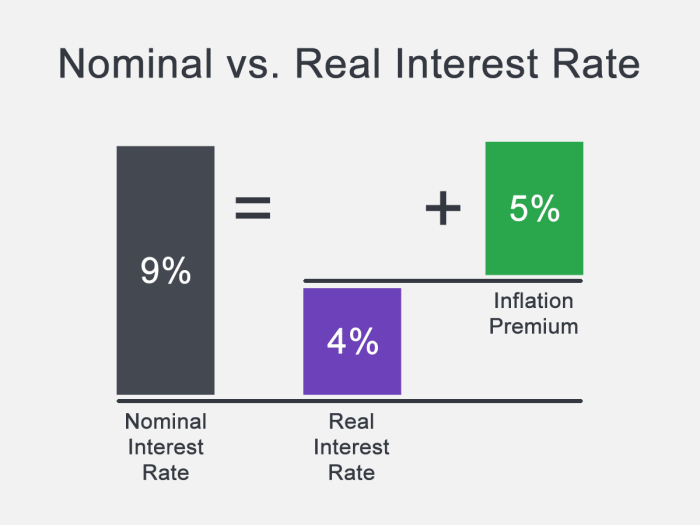

The relationship between nominal and real interest rates is determined by the Fisher equation:“`Nominal interest rate = Real interest rate + Inflation rate“`This equation shows that the nominal interest rate is equal to the real interest rate plus the inflation rate.

This means that the nominal interest rate will increase when the inflation rate increases, and it will decrease when the inflation rate decreases.The following table summarizes the relationship between nominal and real interest rates:| Nominal Interest Rate | Real Interest Rate | Inflation Rate ||—|—|—|| 5% | 3% | 2% || 4% | 3% | 1% || 3% | 3% | 0% |As the table shows, the nominal interest rate will increase as the inflation rate increases, and it will decrease as the inflation rate decreases.

This is because the nominal interest rate is equal to the real interest rate plus the inflation rate.

Implications of Nominal and Real Interest Rates

Nominal interest rates have a number of implications for businesses and consumers. For example, high nominal interest rates can make it more expensive for businesses to borrow money, which can lead to lower investment and economic growth. High nominal interest rates can also make it more expensive for consumers to borrow money, which can lead to lower consumer spending and economic growth.Real

interest rates also have a number of implications for businesses and consumers. For example, high real interest rates can make it more expensive for businesses to borrow money, which can lead to lower investment and economic growth. High real interest rates can also make it more attractive for consumers to save money, which can lead to lower consumer spending and economic growth.The

following table summarizes the implications of nominal and real interest rates:| Nominal Interest Rate | Implications ||—|—|| High | Higher cost of borrowing for businesses and consumers, lower investment and economic growth || Low | Lower cost of borrowing for businesses and consumers, higher investment and economic growth || Real Interest Rate | Implications ||—|—|| High | Higher cost of borrowing for businesses, lower investment and economic growth, higher saving for consumers || Low | Lower cost of borrowing for businesses, higher investment and economic growth, lower saving for consumers |

Questions Often Asked

What is the difference between nominal and real interest rates?

Nominal interest rates represent the face value of interest charged or earned, while real interest rates adjust for inflation to provide a more accurate measure of the actual cost of borrowing or the return on savings.

How do inflation and nominal interest rates interact?

Inflation erodes the purchasing power of money, reducing the real value of nominal interest rates. Therefore, it is important to consider both nominal and real interest rates when making financial decisions.

What are the implications of real interest rates for businesses?

Real interest rates influence business investment and expansion decisions. Higher real interest rates can discourage borrowing and investment, while lower real interest rates can stimulate economic growth.

How do real interest rates affect consumers?

Real interest rates impact consumer spending and saving habits. Higher real interest rates encourage saving and reduce spending, while lower real interest rates can promote borrowing and consumption.